From the coronavirus pandemic and a procession of natural disasters to the superheated presidential election in the United States and its impact on global geopolitics, so much is happening on a day-to-day basis that it feels at times as if we are in a bad dystopian novel.

For anyone involved in data center storage, planning one’s business around these macro-events has been challenging in itself. Factor in global superpowers battling for tech dominance while waging protracted trade wars with no end in sight, and the distortive impact on the supply-demand equation comes as no surprise.

Uncertainty is the New Normal

It’s easy to find examples of commercial uncertainty. Perhaps there is no greater lightning rod than Chinese telecom giant Huawei, at the center of a momentous struggle between Washington, Beijing and other major capitals over the development and control of 5G infrastructure.

The collateral damage is beginning to shake out. Take Japanese chipmaker Kioxia (Toshiba Memory), which recently delayed its IPO against the backdrop of U.S.-China tensions. Kioxia’s decision was in large part prompted by uncertainty over Huawei after the Chinese firm pulled in product ahead of punitive U.S. measures taking effect. Similarly, the new restrictions on Huawei resulted in Micron dialing back its expectations for fiscal Q1.

COVID Drives Digital

Despite these trade challenges, the march of technology has proven remarkably resilient throughout 2020. The onset of the pandemic hastened the transition to a digital-first world, as we found ways to work and socialize from home previously untested at scale. It was surprising to see just how quickly the world pivoted to online life and adopted collaborative tools to virtually manage day-to-day activities.

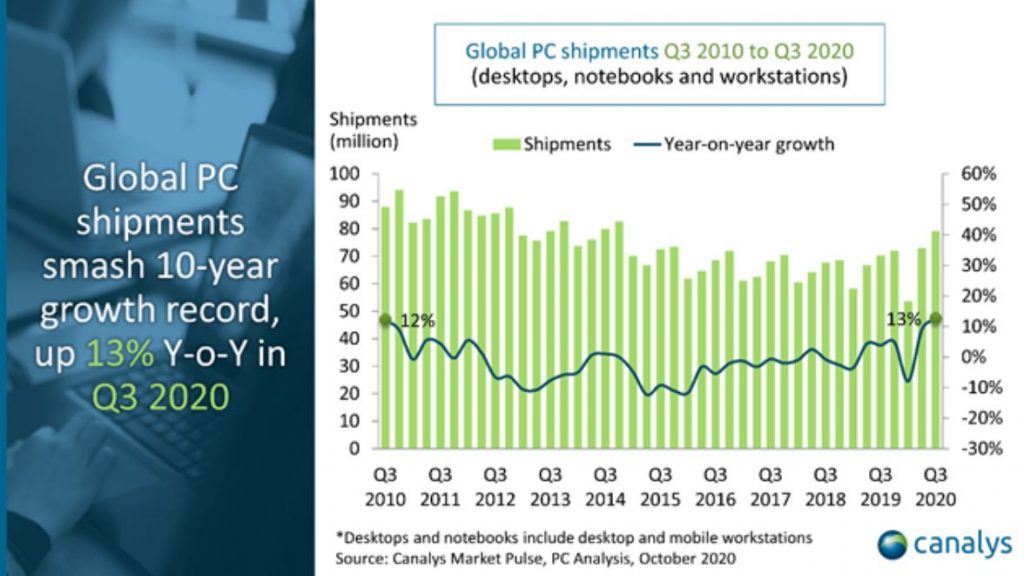

By any measure, the impact on technology purchasing was swift and direct, with an immediate jump in demand for notebooks, tablets, and cloud services. Analyst firm Canalys reported that the PC market experienced its strongest quarter in ten years, with Q3 sales leaping 12.7%, to support working from home.

Measuring Hard Drive Demand

At the same time, the sudden transition to remote working jumpstarted a wave of infrastructure demand—this, in turn, drove cloud investment.

The data clearly paints the picture. IDC reports that Q2 spending on both private and public cloud increased 34% year-on-year, with public cloud experiencing a whopping 48% growth. A total of 3.2 million servers and 128 exabytes of storage were shipped in the second quarter, with hyperscalers reportedly snapping up about 540,000 servers (20% of the total haul) representing 75 exabytes of data center storage.

To put that in perspective, an exabyte is equal to 1 million terabytes. So we’re talking here about 75 million terabytes, or 5,357,142 drives at 14 TB capacity. That’s a lot of drives.

Spend is expected to continue to grow into the second half of 2020 but not at such a blistering rate.

Balancing Data Points

While fun, measuring the storage market in terms of exabytes does not tell the whole story. When analyzing the underlying health and direction of travel of data center storage, the key variables are

- exabytes shipped

- storage unit volumes shipped

- average unit storage capacity

- average unit selling price

Below is a chart from Coughlin Associates comparing quarterly unit volumes and average selling price for WDC and Seagate:

When digging into Q2 numbers, we see average unit capacities increasing against declining volumes, which drives up the average selling price per drive. This supports the dual narrative that

- SSD adoption will continue its growth in the enterprise data center

- HDD increasingly dominates demand for mass data storage

Nowhere is this split trend clearer than in the demand outlook for nearline HDD drives. Nearline is proving central to HDD’s dominance as the low-cost option for non-critical data center storage in the cloud.

The growth in nearline sales comes amid an overall flattening of total HDD revenue, which for 2020 is projected to drop 6% year-on-year to $20.7 billion. This follows a 12% decline in 2019 on the previous year.

It’s then back on the upswing, with Gartner forecasting that HDD revenue will near $22 billion in 2021 and climb further in 2022 to $22.6 billion.

Here again, the plight of Huawei—which owns 6% of the global server market— partially affected the most recent sales numbers as the firm pulled in drives ahead of U.S. imposed restrictions.

Growing Areal Density

As data volumes surge, so does the need for manufacturers to offer higher capacity drives through increased areal density. Make no bones about it, this is the central value proposition of enterprise HDD—offer the densest storage solution at the lowest cost per byte.

Looking back at WDC and Seagate’s roadmaps for their next-gen drives, each company approached the solution differently. WDC‘s primary bet was on MAMR (microwave assisted magnetic recording) as its path to 40TB capacities, while Seagate touted HAMR (heat assisted magnetic recording) as its technology of choice.

Here’s the rub though: while PMR (Parallel Magnetic Recording) and CMR (Conventional Magnetic Recording) have reached their capacity limits, neither MAMR nor HAMR are ready for prime time.

Interim technologies include:

- SMR (shingled magnetic recording), utilizing the partial overlaying of tracks to increase areal density

- TDMR (two-dimensional magnetic recording), relying on multiple read elements to generate a stronger signal-to-noise ratio, which enables greater areal density

Both achieve the goal of increased areal density but with drawbacks. SMR offers a 25% increase in areal density but at the expense of performance, working best in sequential-read environments. TDMR delivers a 20% boost over PMR, but due to complexity is more expensive—blunting HDD’s cost advantage over SSD.

Skipping a Step

For its part, Western Digital introduced its latest drive technologies with EAMR (energy assisted magnetic recording) for 18TB and 20TB capacities, a step closer to a MAMR drive that is used across PM, CMR and SMR drives.

In doing so, WDC bypassed 16TB capacities, jumping straight to 18TB. The firm stated that data centers were skipping from 14TB to 18TB drives, as the 14TB were in mid-cycle within the refresh cycle.

However, both Google and Amazon are utilizing 16TB drives so there may be truth to rumors of WDC struggling to sort its 8-platter spin torque approach. Toshiba is also using a mix of SMR, TDMR and MAMR technologies.

Incremental Progress

Seagate introduced its 18TB (9-platter, helium-filled) drive in September as an iterative step towards its HAMR-based 20TB (9-platter, 18-head, non-shingled) drive due to ship at year-end.

The technology utilizes multi-actuator arms with two sets of read-write heads that logically divide a disk drive into two halves and perform read/write operations simultaneously to increase overall input/output throughput. Seagate believes HAMR provides a pathway to 40TB plus capacities.

Burgeoning Demand

Despite not meeting their original roadmaps, each of the HDD makers continue to innovate and play to their advantage, staking out their positions in surveillance and bulk storage. This is not a bad place to be given market trends.

“The amount of data created over the next three years will be more than the data created over the past 30 years, and the world will create more than three times the data over the next five years than it did in the previous five,” according to projections from IDC.

The Maturing of SSD

The SSD market has matured, with pricing reaching the point where the performance gain over HDD offsets the higher cost of SSD. This, in turn, allows SSD to make significant advances within the computing space.

It’s been heading this way for some time. As CPU, APU, and GPU horsepower increases, SSD is filling the gap where HDD fails to deliver on performance.

Nowadays, SSD consumes almost all notebook storage sockets. HDD manufacturers have effectively divested from further investment in notebook technology.

Meanwhile, the increased standardization of NVMe-oF in the data center has markedly boosted SSD. The fact is HDD cannot compete with SSD in low latency environments.

Competing Tensions

The SSD space is not without its challenges, though. NAND, the raw component used to assemble SSD for storage drives and handsets, is a capital-intensive business that behaves like a commodity. As with any commodity, this adds volatility and complexity to the supply demand equation, lending itself to boom-bust cycles that drive imbalances.

This leads to an inherent conflict in the flash sector. On the one hand, WDC’s new CEO David Goeckeler is quick to recognize the commercial upsides of SSD. “We believe flash is the greatest long-term growth opportunity for Western Digital and is an area where we’ve already had a tremendous foundation with consumer cards, USB drives and client and enterprise SSDs,” he remarked on a recent earnings call.

On the other hand, take Intel’s announcement of the sale of its NAND assets to SK Hynix.

While Goeckeler correctly calls out that SSD is the future, Intel’s decision to divest highlights in a nutshell the challenges of operating within the NAND space. Here we see the good and the bad of the NAND business.

Innovation on Ice

In terms of innovation, there has been little new in NAND or SSD technology for 2020. For the most part, NAND manufacturers have hit the wall in terms of advancements.

- Samsung is struggling to move past its 100-layer designs, while those stacking dies to increase NAND density are learning that stacking has its limitations.

- Micron is sorting through its transition from floating gate to charge-trap technology.

- With Intel selling its NAND business, we perhaps understand why the firm has been slow to innovate, choosing to milk its assets instead.

For their part, the hyperscalers initially looked to optimize flash performance through customized solutions. Lately though we are seeing increased adoption of standardized SSD designs based around the ground-breaking NVMe interface.

NVMe-oF allows for demand scaling intended to optimize cost and performance within a shared resource compute environment, such as hyperconverged and composable infrastructure.

Pricing Fluctuations Continue

Going into 2020, SSD pricing benefited from Chinese hyperscalers and cloud companies building up stocks to hedge against the trade war.

Just as pricing began to soften, NAND’s outlook was buoyed by strong demand for PCs and servers in the second quarter as the COVID-19 pandemic drove demand for cloud services and hardware to support the work-from-home revolution that arose almost overnight.

For Q2 2020, these crosswinds resulted in total NAND flash bit shipments and average selling prices both experiencing minor increases of 3% quarter-over-quarter—with NAND flash revenue reaching $14.5 billion, a 6.5% increase.

Although the price decline is less than the previously expected double-digit drops, Gartner projects enterprise SSD prices to fall by 10% to 15% from Q3 2020 to Q4 2020. Weaker demand for handheld devices, data centers consuming SSD stock, and a deceleration in PC sales are driving this decline.

Expect pricing to continue to drop through the first half of 2021, with prices falling in excess of 20% from 2020 levels.

Industry Changes

Set against the disruption of the pandemic, the industry landscape continues to evolve. We are seeing a reshuffling of the packs with Chinese NAND upstart YMTC coming on the scene and hitting full fab utilization for its 256GB TLC NAND. While YMTC has a way to go before making a significant near-term meaningful impact, it does put manufacturers on notice to invest to maintain their edge.

Elsewhere, WDC announced it is splitting its storage business into two units (for SSD and rotating media), while Intel’s sale of its NAND assets to SK Hynix is a healthy consolidation. It allows Hynix to focus on integration rather than building additional capacity, thereby improving market dynamics.

A Double-Edged Sword

While all eyes are trained on the U.S. presidential election, we remain knee deep in a digital revolution placed on steroids by a raging pandemic that forces us to examine every aspect of our lives. As a global community, we are desperately grappling with the systemic changes that technology brings.

Throughout history, technology has improved our lives—but with it always came unintended consequences. Never has it been more important to understand the good, the bad, and the ugly of what technology offers.

Stephen Buckler is chief operating officer at Horizon Technology, the leading provider of asset recovery solutions for enterprise storage.

Connect with Stephen on LinkedIn or get in touch for more information on how Horizon can help you get more out of your data center storage.