Its founders herald it as the green successor to Bitcoin. But in a world where new digital currencies can feel a dime a dozen, the most novel thing about Chia may be the supercharged impact it’s having on the marketplace for data storage.

So, what potentially is the long-term effect of Chia cryptocurrency farming on the data storage market? Let’s start by defining what Chia is.

What is Chia?

A Prolific Founder: The first thing to know about Chia is that it has an illustrious founder. Bram Cohen, inventor of distributed file sharing protocol BitTorrent, established Chia Network in 2017.

It’s not unreasonable to infer that what Cohen did for global file sharing, he can also do for digital currency.

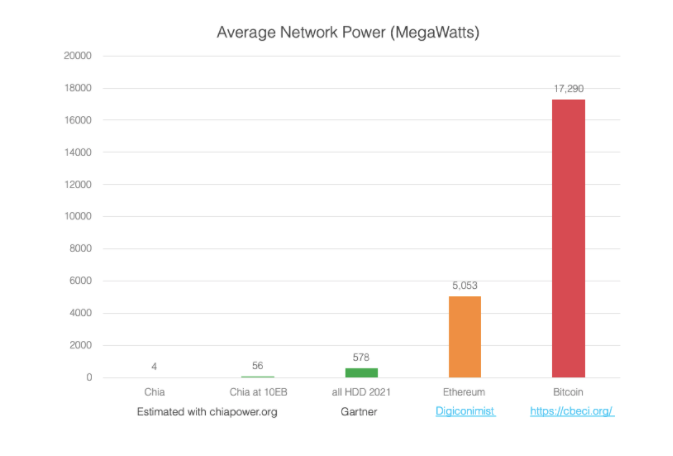

Chia is not Bitcoin: The company couldn’t be clearer on this point. Bitcoin uses a Proof of Work model, in which “miners” perform complex computations to verify transactions, and are rewarded with bitcoin. This model draws heavily on processing power, which shows in its energy footprint; if Bitcoin were a country, it would rank alongside the top 30 nations in the world in terms of total energy consumption.

Chia, by contrast, uses a Proof of Space and Time protocol based around storage capacity. Instead of “mining,” there is a two-stage process: “plotting” and “farming”. The plotting stage, in which data is encrypted and allocated to a storage device, is the most computationally intensive stage.

After the data is plotted, plots will be called at random by the Chia network to prove that the encrypted data still resides in the space to which it was allocated. The more space one plots, the greater the chance that one’s plot will be selected by the network. If your plot is selected, and the data is still stored there, you are rewarded with Chia coin.

“When a new block is broadcast on the Chia Network’s blockchain, farmers will scan their plots to see if they have a number that is close to the new challenge number derived from the previous block. This operation of checking for a Proof of Space is fast and very efficient – farmers are known to farm a petabyte on one Raspberry Pi.”

Chia’s white paper released early 2021

Storage needs depend on the stage. SSD cards are optimal for fast and efficient plotting, though other storage devices can be used. After the initial plotting is finished, the plot can be moved to whatever affordable device can store the most data, typically a high-capacity HDD. The upshot is that the growth in Chia is driving demand for a variety of storage devices, as Chia farmers mix and match to figure out which hardware is most efficient.

Supply Chain Disruption

“The Proof of Work method that the Bitcoin protocol uses included an assumption that unused CPU cycles are a vast excess commodity in millions of computers worldwide. This premise did not ultimately prove to be correct but it was prescient to search for a vast excess commodity. Instead of consuming massive amounts of electricity and wasteful single-purpose ASIC hardware to validate transactions, Proof of Space leverages the over-provisioned exabytes of disk space that already exist in the world today.”

— Chia’s senior leadership in a white paper released early 2021.

Principles are all well and good, but the proof of the pudding is in the eating.

Here the narrative is less straightforward. Rather than quietly absorbing excess storage capacity, Chia Coin’s launch quickly added pressure to an overextended supply chain.

A whirlwind few months followed. In China and neighboring countries, it sparked a buying frenzy, with Chia farmers gravitating toward enterprise devices due to their higher capacities and endurance. It spiked prices and triggered shortages for both consumer and enterprise-grade devices.

Enterprise HDD prices have since come down considerably, although most still sell for far more than their MSRP (Manufacturer Suggested Retail Price).

Some drives, such as Seagate’s Barracuda Pro 14TB, remain largely unavailable. Meanwhile, prices of consumer-oriented drives are still rising, or staying at expensive levels.

Chia Data Storage: Counting the Exabytes

The global storage footprint associated with Chia farming quickly racked up. In the first two weeks of May alone, the number of exabytes dedicated to Chia farming increased sixfold. Recently, the growth curve appears to be leveling out. But the total netspace still stands at almost 30EiB.

To put this in context, one in every 200 bytes of installed storage capacity worldwide is now dedicated to Chia (based on IDC’s 2020 estimate of global capacity).

The question is what happens next? How long will demand for Chia storage persist? Bram Cohen speculated in a mid-May tweet the growth curve might top out around 115 EiB.

But he was equally quick to point out how difficult it is to predict the exact behavior of an S-growth curve. And unlike Bitcoin, there is no cap on the number of Chia coins that can eventually be farmed.

Impacting the Data Storage Market

For their part, Chia executives argue that the new currency will prove beneficial for the data storage market in a number of ways. Not only will Chia increase marketplace demand, Chia farmers will help utilize storage capacity that currently sits fallow.

There are other creative uses. Storage manufacturers can generate additional revenue by turning over their drive burn-in and quality assurance processes to plotting and farming Chia. “Optionally, manufacturers can set up drives for larger customers to have the QA process plot and farm rewards to the farming rewards pool of their customers.”

For large purchasers of storage, this may help defray acquisition costs by ultimately lowering cost per terabyte, the company’s founders suggest. The drive makers are certainly warming up to the possibility of increased production over the long term.

Seagate CFO Gianluca Romano struck a positive note at a recent conference. Though the sudden surge in storage demand was unprecedented, it helped Seagate utilize its extra storage capacity, he explained. In addition, it is allowing a better alignment in supply and demand, enabling Seagate to move more quickly to an equilibrium it hadn’t expected to achieve until June 2022. The company plans to take advantage of the new demand for as long as it lasts.

“This new demand is basically helping us to improve for sure in the short-term, and bridge from a situation of underutilized capacity to a situation of almost fully utilized capacity. And then, in two or three quarters we see where we are, and if it’s still a great opportunity, we can upsize and increase the volume or staying as we were planning before, still in a very good situation,” Romano remarked.

Meanwhile, Western Digital sees Chia as a new vertical market providing an extra boost to what was already projected to be a strong year. During a recent presentation, WD CFO Bob Eulau was tentative but upbeat:

“We don’t really know what the longevity is going to be—whether it’s a little bit of a short-term spike, or whether it’s something we’re going to be able to count on for many years to come,” Eulau said. “But overall, we think the value proposition is strong. It’s a lot less power intensive than the traditional compute-based cryptocurrencies.”

Chia Data Storage: Greener than Bitcoin?

Bitcoin is not exactly a green technology. As we mentioned, its total annual energy draw is among that of the 30 largest energy-consuming countries in the world. And it’s sharply growing as the value of the currency rises.

Just ask Elon Musk about his decision to stop accepting Bitcoin for vehicle transactions until BTC develops greener ways:

“We are concerned about the rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel. Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment.”

Elon Musk on his Twitter feed

Unsurprisingly, Chia says it’s ready to step up to the eco-plate. Marketing itself as “green money for a digital world,” it has invested not inconsiderable time and resources—including the participation of former Intel storage leader and newly-appointed Chia VP Jonmichael Hands—in setting out its enviro-friendly stall through its Chia Power site:

Of course, HDDs used in chia farming are hardly known for their power efficiency compared with the SSDs used in chia plotting. Chia recognizes this and is banking on an accelerated migration from HDD to SSD in the coming years. Fast and efficient SSDs would be used for chia plotting, and the encrypted plots would then be moved to SSDs with high storage capacity.

While there’s little doubt that SSD will continue to increase as a proportion of the storage pie, the assumption that HDD is heading over the cliff — as put forward by David Floyer in a recent Wikibon analysis, and cited by Chia in its company statement — appears misguided. Consider the staggering explosion in data generation set to take place in the next few years. Solid state devices can’t possibly sponge up all those zettabytes.

Given this, Chia farmers will likely continue to gravitate toward where the capacity is most readily and affordably available—namely, HDDs.

Encouraging Drive Reuse

Not that deploying SSD for crypto farming is without its environmental impacts—frequent overwriting of the drive shortens the lifespan of flash. The world is already suffering from a mounting e-waste problem, and Chia farming won’t help here.

Many commentators on chia compare chia “farming” to bitcoin “mining”. This can be misleading, as the plotting stage is the most computationally intensive part of the chia protocol. While still less intensive than the proof-of-work calculations, plotting calculations wear through SSD cards. The leads to e-waste, as computing components containing rare metals are toxic and near-unrecyclable after use. As a result, Chia plotters look for SSDs with high TBW (Terabytes Written).

But it could prolong the life of otherwise functioning drives by encouraging the secondary market for data center storage. The firm readily makes this point. “[Such] data center cast offs are excellent for farming and we believe we will create a market for them that keeps them out of landfills for significantly longer and greener lives,” it says.

Nonetheless, there’s an underlying element of wishful thinking to the Chia founders’ position. For instance, they are quick to point to Bitcoin’s founding belief that tapping unused global CPU capacity would ultimately spurn an environmentally benign means of production.

Instead the Bitcoin winners have turned out to be those with access to the most powerful computer hardware and the cheapest sources of electricity, largely based on fossil fuels. Surely, similar hacks will emerge over time for storage-based crypto.

That said, the principle of basing a cryptocurrency on storage rather than processing power is less energy intensive and greener by nature. And, for that, Chia deserves credit, even at this early stage.

The Long View

As with any craze, only time will tell how permanent an impact Chia will have on the data storage marketplace. For now, the smart money is on it remaining a noticeable market force, at least for the foreseeable future.

Chia’s eventual fortunes will likely land somewhere between the hype and the skepticism. The network’s bosses agree. “Like all new technologies, the impacts of digital currencies and blockchains are overestimated in the near term and underestimated over the long term,” they assert.

As with everyone else in the data storage industry, we’ll continue to watch closely.

For help navigating the global supply chain for enterprise drives, get in touch with Horizon Technology and draw on our deep industry expertise.

Related Resources

- Chia cryptocurrency comes for the hard drive

- What is ‘green’ cryptocurrency Chia and just how eco-friendly is it?

- Elon Musk looking for green alternative to Bitcoin for Tesla

- Which cryptocurrency is the most environmentally friendly?

- Chia crypto mining could obliterate your SSDs in a matter of days

- China cryptocurrency craze drives hard drive shortage in Vietnam

- Chinese coin miners flock to new cryptocurrency Chia resulting in hard drive shortages and price surges

- Chia Coin spurs HDD shortage: prices up, high capacities sell out