Semiconductor fabrication forms part of a complex global network that crosses borders, stokes rivalries and may just prove the key to future prosperity.

The modern world runs on computers. That’s been true for years, and is getting truer every day as big data and AI shape the tech world. To capitalize on the explosive growth in the global IoT and datasphere, foundries need to up the quantity and quality of computer chips.

But semiconductor fabrication is a delicate process. Chip production takes place in stages, with a huge number of players involved. As if things weren’t complicated enough, there’s geopolitics to consider. The same countries vying for influence also depend on each other for niche products and services.

This year promises to shape semiconductor fabrication for decades to come. Several nations are going all-in on fab construction, and if a more secure chip supply results, that makes everyone’s life easier. Here’s a look at the current state of play, how new fabs will shape production and what the effect on the data center will likely be.

A Global Web: Current State of Chip Production

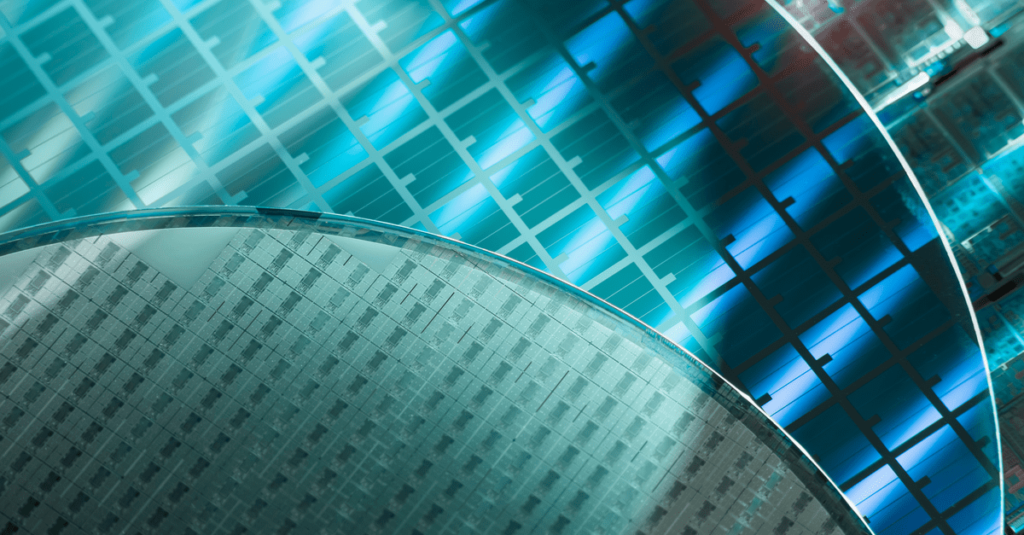

State-of-the-art microchips are among the most advanced pieces of tech humans have created. So, it’s not surprising that making them is a complex process.

You can divide semiconductor production into three phases: upstream, midstream, and downstream.

| Task | Examples | |

| Upstream | Chip design | Apple, Intel, ARM, AMD, NVidia |

| Midstream | Fabrication | TSMC, Samsung, Intel, GlobalFoundries |

| Downstream | Testing and packaging | Amkor, Jiangsu Changjiang Electronics Technology, Tongfu Microelectronics |

Judged by revenue, the largest chip manufacturer by far is Taiwan’s TSMC, with a 53% market share. Second place is Samsung, with a 16.3% market share. When it comes to more advanced chips, TSMC is even more dominant, with a market share of over 90%.

So, Taiwan and Korea run the game, right? Not quite. The market dominance obscures how interconnected Taiwanese and Korean firms are with those located elsewhere. While Taiwan also has strengths upstream and downstream in the supply chain, it can’t go it alone.

Almost a quarter of the global installed wafer capacity is located in China, though 30% of that is owned by multinational firms. The nation is also a leader in OSAT (Outsourced Semiconductor Assembly and Test), with a 38% market share. Upstream, foundry companies rely on chip designers for business, bringing the U.S., Japan, and the E.U. into the mix.

Connections abound. A multinational firm based in Taiwan with a fab in mainland China might fabricate a chip designed in Japan, packaged in China, and bound for the United States. Semiconductor production is like a vast web. There’s an ever present temptation for national actors to pull on individual threads in order to compete with geopolitical rivals.

The Rise of Chinese Tech: Rapid but Qualified

When you include fabless chip designers, Chinese firms saw $39.8 billion in sales in 2020, the most of any country. That’s up from $13 billion in 2015, so they’re catching up fast. Their foundries are growing too: in 2025, foundry company SMIC saw 36% y-o-y growth. With 28 additional fabs planned, Chinese tech has big ambitions.

But not everything goes according to plan, and there are signs that Chinese leader Xi Jinping is displeased with the progress. A number of corruption investigations have been opened, with subjects including a former YMTC chairman and the head of Big Fund, which invests in many of China’s largest chip projects.

There’s also been a rush of inexperienced companies rebranding as chip manufacturers to gain access to land and money. Six projects went bust after raising $1 billion each.

Adding to China’s difficulties are U.S. restrictions. China has cut down on manufacturing of logic nodes when the U.S. added Huawei and SMIC to the government entity list. More recently, the U.S. has blocked Nvidia from selling high-end A.I. chips to China. Since Nvidia has a 95% market share in A.I. accelerator chips, this will heavily curtail China’s ability to develop cutting-edge tech.

Ain’t Over Till It’s Over: The Chip Shortage

With so many players, the system is fragile. The chip shortage isn’t over yet: More than half a dozen chip suppliers have increased prices this year.

RELATED READING

Even given the chip shortage, data centers, as increasingly essential infrastructure, have fared well. As reliable buyers, they’re often favored by chip sellers, and hyperscalers have considerable purchasing power as well.

As always, this shortage affects companies differently. For example, Cisco has been vocal about its difficulty getting hold of chip components of network switches and routers. Since those are important for data centers, asset managers should keep tabs on how the pricing situation develops.

The U.S. CHIPS In

The picture so far: there’s a complex, interconnected, multi-stage process for chip production. Taiwan leads in chip fabrication, but China, despite setbacks, is gaining momentum.

In response, the U.S. has passed the CHIPS & Science act. “CHIPS” stands for “Creating Helpful Incentives to Produce Semiconductors”. True to its name, $52 billion of the bill’s $280 billion in funding will be spent boosting U.S. semiconductor production. Other initiatives to receive funding include research on robotics, A.I., and quantum computing.

A major driver behind the act is competition with China, which has spent $80 billion in subsidies on tech, and plans to invest $70 billion more. Nor is it a two-way race: last year, Korea announced a $450 billion package of investments in domestic tech.

A FAB-ulous Boost for Semiconductors

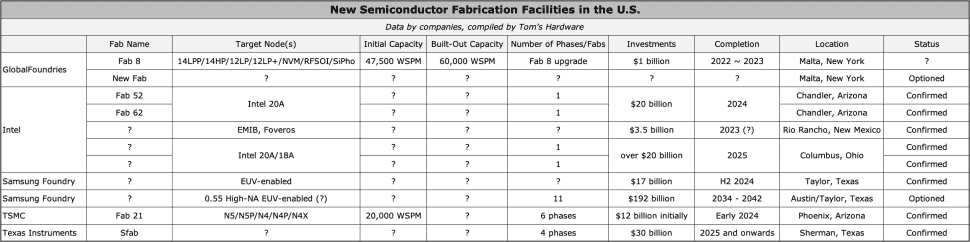

The most visible effect of the CHIPS act has been to accelerate the trend in constructing fabs on U.S. soil. TSMC, Samsung Foundry, Intel, Texas Instruments, and GlobalFoundries are all building semiconductor fabs in the U.S.

The act’s passing was much needed good news for Intel. The firm posted a $500 million loss in Q2, with revenue declining 17% year-over-year. Now the company can expect to see $10-$15 billion in subsidies over the next five years. While its plans to bring semiconductor fabrication to the U.S. predates the passing of the CHIPS act, the financial boost will help with expensive construction. The Arizona fab alone will cost $30 billion.

Another big winner is Micron, which plans to invest $150 billion in U.S-based semiconductor fabrication and R&D. The firm could see as much as $10 billion in funding from the passage of the act. That’s big news for data storage, as Micron pushes to challenge leading NAND manufacturer Samsung.

CHIPS and Data Centers

Those who stand to benefit the most in the short term are researchers and foundries that will receive subsidies over the coming years. But like any funding for construction and R&D, the wider impact will be indirect, and several years away. That’s unsurprising, as a state-of-the-art chip fab can take about three years to get up and running, and even longer to ramp up output.

How clean is your room? While air in a typical city contains upwards of 35 million particles per cubic meter, semiconductor fabrication requires a “clean room” of level 5 or lower. In such rooms, there are less than 3500 particles per cubic meter, all smaller than a millionth of a meter.

When the wider impact does arrive, the most obvious upshot is easier access to those purchasing from U.S. fabs, as well as lower chip prices in the long-term. This can also result in lower prices of any tech which uses these chips. That affects everyone, including data centers.

The boost in chip production could also be big news for flash storage. Micron is of growing importance in NAND fabrication, boasting major clients such as Apple. Another client is Pure Storage, an all-flash storage company using Micron’s record 232-layer NAND in select flash arrays.

Pure Storage itself has sealed some massive deals with the likes of Meta, Azure, and Equinix. If NAND fabs constructed by companies like Micron lower prices, companies like Pure Storage or VAST data could capitalize on it and accelerate the move to all-flash arrays.

While a hefty chunk of CHIPS funding goes to chip production, the funding for A.I. research shouldn’t be overlooked when it comes to indirect effects on the data center. Much of A.I. relies on machine learning to extract insights from vast quantities of data.

RELATED READING

Improvements in A.I. could lead to big developments in data center automation.

The more plentiful and cheaper A.I. accelerator chips become, the easier this is. A.I. can help with everything from predicting drive failure to automating aspects of licensing compliance.

The Long Game

Despite all the breathless news stories, what’s happening now is unlikely to have immediate effects, except when it comes to research and constructing foundries for semiconductor fabrication. However, the CHIPS act and restrictions on selling tech to China will have huge implications for the geopolitical balance of the tech industry moving forward through this decade and into the next.

Leaving aside geopolitical rivalries, the changes in chip production will also have considerable (if hard to trace) effects on availability and prices. It could accelerate the push to all-flash storage. Also, A.I. research may lead to automation being more effective than ever.

Chip manufacturers are playing the long game. There’s a lesson in that for all businesses, including data centers: keep your feet on the ground, and eyes on the horizon.

Horizon can keep your hardware lifecycle grounded by helping you reuse, refresh, and recycle your storage hardware.