What’s the outlook for enterprise hard disk drives (HDD) in the data center?

Will the current surge in demand for affordable high-cap storage keep HDD on top? Or are solid state drives (SSD), fueled by long-term declines in NAND flash prices, on track to eclipse enterprise HDD as the dominant storage technology?

After years of supply chain turbulence which rattled the tech industry, demand for HDD is back in force. Even given advances in flash, most data still resides on spinning platters, and the dawn of HAMR drives is ramping up areal density. For the foreseeable future, enterprise HDD will have a central role storing data cheaply at scale.

Good Times for Hard Drives

The immediate years preceding 2024 were rough ones for HDD manufacturers.

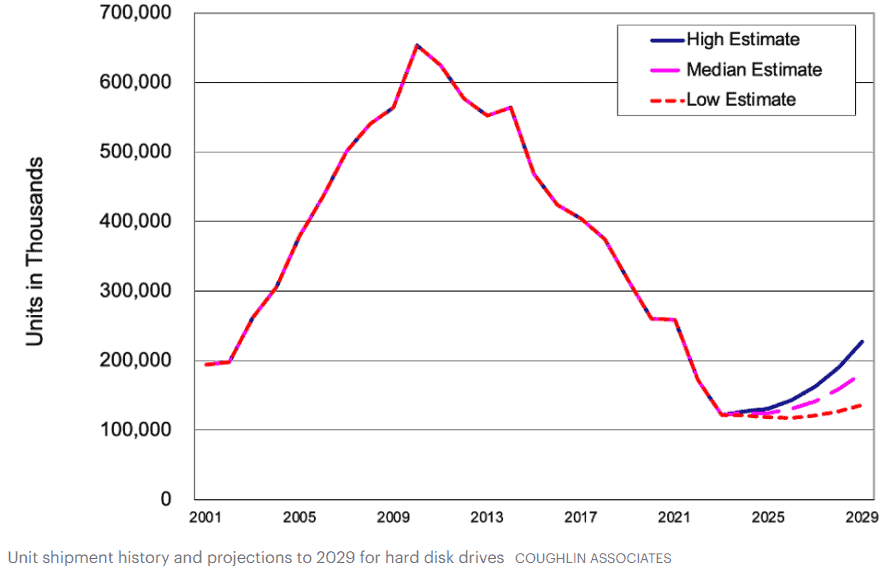

In 2Q2022, there was a 33% y-o-y sharp drop in shipped units due to reduced demand for consumer HDD. A year later, it was clear the decline was also coming for nearline drives, with 3.5” high cap drives seeing a stunning 45% drop in shipped units in 2Q2023. But flash was hurting too: in early 2023, Micron saw its worst downturn in 13 years, Samsung’s profits hit an 8-year low, and Intel posted the largest loss in its history.

But now the good news: demand is picking up again. According to analyst Tom Coughlin’s projections, 2024 saw a 42% y-o-y increase in unit volume shipments of high-cap nearline hard drives.

According to the same late 2024 projections, overall HDD capacity shipments increased by an estimated 39% y-o-y, and HDD revenues were up by an estimated 49% y-o-y. The message is clear: HDD has returned.

Seagate & Western Digital are using the situation to their respective advantages. Coughlin reported an average sales price (ASP) increase of 4.9% q-o-q for HDD in 3Q2024. In 1FQ2025, Seagate’s revenue was up 49.1% y-o-y, and WD’s revenue was up 85% y-o-y over the same period. With HDD companies entering into long-term agreements with major clients, clearly manufacturers are sanguine about the next few years.

The Relentless Rise of Data Storage

Current demand for high-cap nearline HDD is looking good. And no wonder: data is being generated faster than ever, and attempts to monetize it will drive demand for storage in the long-term.

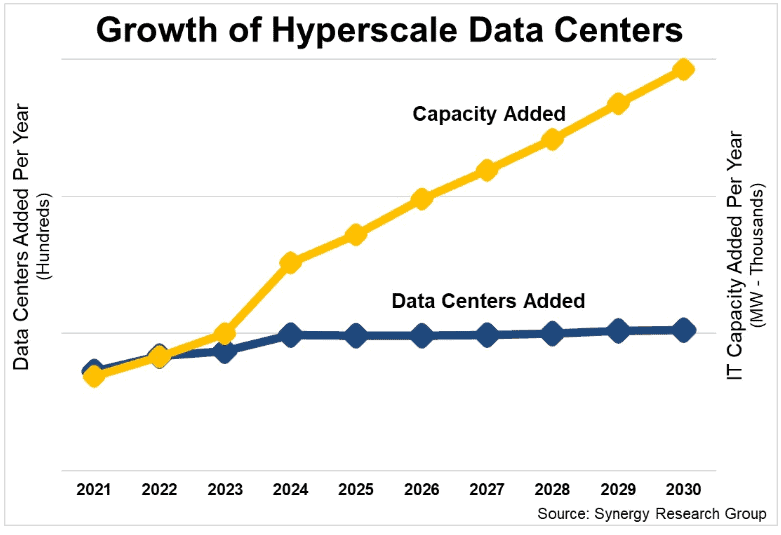

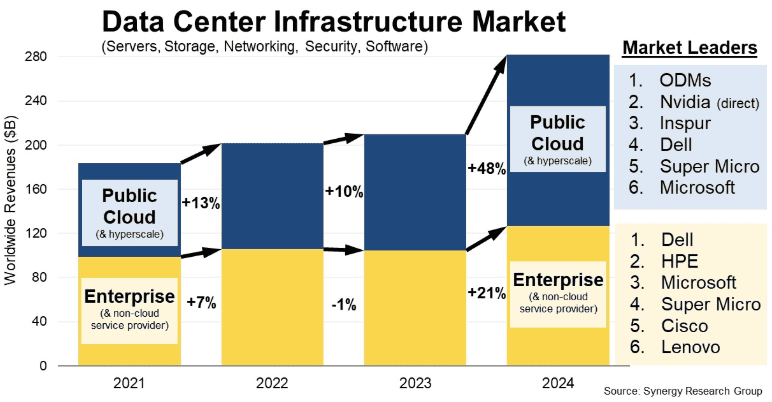

AI is leading to a massive boom in data center construction. In a Synergy Research Group analysis of 19 major cloud and internet service firms, it found that these firms collectively had 1,103 major data centers, and 497 more in the pipeline. Synergy’s big prediction: that total hyperscale data center capacity will almost triple by 2030.

While this seems like a big jump, they’ve got the data to back it up. Data center hardware & infrastructure were up 34% y2-o-y in 2024 (48% y-o-y for public cloud infrastructure). Total revenues for data center equipment was $282 billion over 2024.

That spending means a lot of exabytes, the lion’s share of which will be on spinning platters.

Cloud Storage Holds Strong

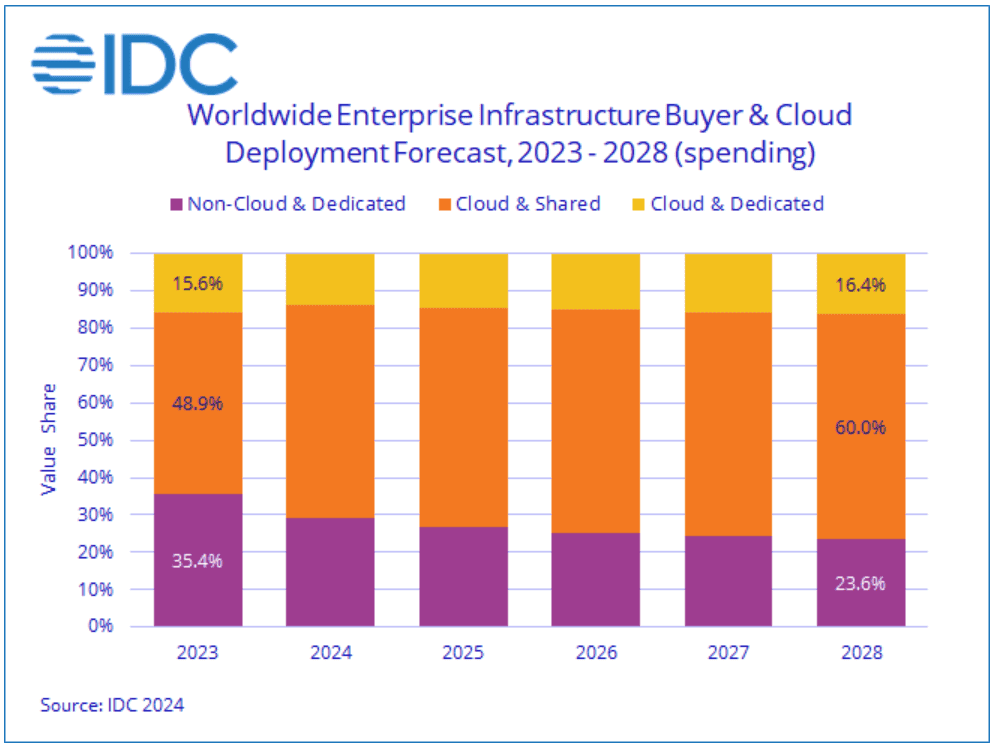

Speaking of the cloud, cloud storage growth as measured by spending is still going strong. According to IDC estimates, 89% of data stored by lead cloud service providers still resides on HDD. If that continues, HDD is about to have a big few years.

IDC data showed that spending on cloud infrastructure was up 61.5% y-o-y in 2Q2024. it also predicted that cloud storage would grow as a % of spend.

This coheres with Gartner’s prediction in late 2024 that 2025 would see end-user cloud spending increase 21.5% y-o-y to $723.4 billion.

Of course, it’s not an either-or situation when it comes to storage technologies. Tape serves as a good analogy here. It remains unlikely that HDD will develop into a credible threat to tape as a medium for cold storage in the hyperscale data center. Just as tape still has its place in the storage mix, enterprise HDD will likely retain its place in the cloud as the data storage workhorse.

Related Reading

Giving areal density a much-needed boost, Heat-Assisted Magnetic Recording (HAMR) is crucial to manufacturer capacity roadmaps.

Sunny Forecast for HDD

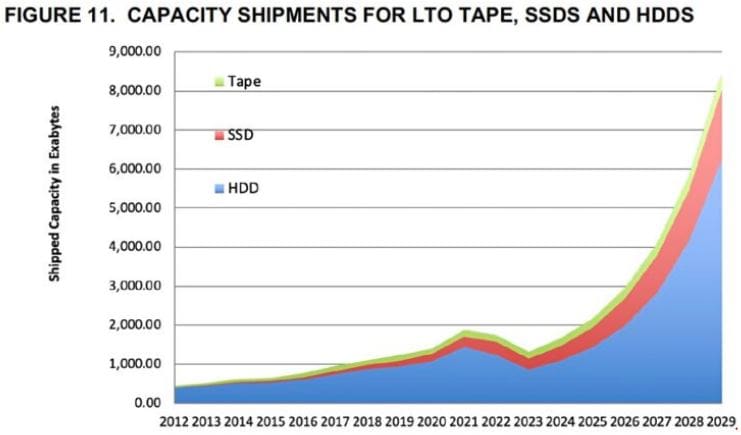

Unsurprisingly, this huge boost in hyperscale data center capacity and cloud spending will likely lead to a similar bump in shipped capacity for nearline HDD.

Tom Coughlin believes that HDD capacity shipments will be around 7.3ZB by 2029. He further predicts nearline HDD will comprise over 90% of these shipments, compared to 54% today. HDD won’t be the only beneficiary of the boom: Coughlin projects that HDD, SSD, magnetic tape, and optical should all see their capacity shipments grow 5x between 2024 and 2029.

No surprise then that the major hard drive manufacturers—Seagate, Western Digital, and Toshiba—are doubling down on their HDD product road maps. The prospect of relentless data growth clearly supports their confidence.

HDD vs SSD

None of this technological development reflects poorly on solid state drives—the opposite in fact. Indeed, flash is already the default choice for storage outside of the data center. “HDD makers have long since recognized the inevitability of the notebook entirely transitioning to SSD,” remarks Stephen Buckler, chief operating officer at Horizon Technology.

However, this does not spell the end of the hard drive, Buckler insists. “Increasingly storage is all about the cloud. As AI and big data play an ever greater role in our day-to-day lives, this increases the need for cheap storage. Storage leaders such as Seagate and Western Digital continue to invest in improvements to hard disk technology, signaling that the game is far from up for HDD.”

AI is a major driver of demand for storage. According to a Recon Analytics survey commissioned by Seagate, 61% of correspondents said their cloud-based storage would more than double over the next three years. And when it comes to data retention, 90% believed the practice improved the quality of AI outcomes.

Limits to manufacturing will also help keep HDD in play. Pure Storage R&D VP Shawn Rosemarin argued in 2023 that there will be no more HDD sales after 2028. But Chris Mellor at Blocks & Files estimates that even given advances in flash capacity, NAND production in 2029 will fall about 405EB short of what would be needed to replace HDD capacity. While he has since come around to the view that SSD has a lower TCO, limitations on the pace of SSD fab construction ensures that HDD will remain critical in the years ahead.

Related Reading

Whether HDDs remain the cheap option depends on how you use it. Check out our guide for how to reduce HDD operating costs in your data center.

How to Lower Total Cost of Ownership (TCO) for Hard Drive Storage

New HDD Technologies

There remain good grounds for the three main hard drive makers to feel very optimistic about the medium-to-long-term outlook for HDD.

HDD manufacturers have been squeezing in extra platters and widely promoting SMR technology (shingled magnetic recording) for data center drives. However, they are also upping the ante on areal density with the use of heat-assisted magnetic recording (HAMR)

True to its name, Seagate’s Exos M 32TB HAMR drive packs 32TB into only 10 platters. From there, the firm plans to move to 36TB, 40TB, and 50TB drives, each with greater areal density than the last. The firm has also experimented with 5TB disks in the lab. While no firm dates were given, Seagate CFO Gianluca Romano expects that there will be a gap of 18-20 months between HAMR capacity increases.

Related Reading

You can’t make high-cap drives without high-cap plates. From improved media, and exotic materials to 3D HAMR recording, HDD innovators have no shortage of ideas.

Some Seagate drives also employ multi-actuator technology, which is designed to unlock additional IOPS for improved read/write performance.

Western Digital has also been going the HAMR route. CFO Wissam Jabre said back in 2023 that the firm was around 12 to 18+ months away from volume production of HAMR drives. These drives will also likely utilize WD’s innovative OptiNand technology, which augments HDDs with a small flash controller that stores metadata. While they haven’t appeared yet, Coughlin believes starting HAMR production wouldn’t be too difficult for WD.

While the technical approaches may vary, what appears certain is that HDD is poised for significant capacity growth in the years ahead.

Catch a Rising Tide

The future storage mix is always tricky to predict, as unexpected innovations can lead to rapid change. But for the moment, with hard drive sales picking back up and HAMR delivering long-promised increases in areal density, HDD is likely set for a boom over the next few years. HDD currently dominates as a share of data center storage, and this is unlikely to end anytime soon.

At the same time, flash continues to strengthen across storage use cases, and will grow as a proportion of an expanding pie. In a world of diverse storage uses, analysts would do well not to overemphasize the conflict between HDD and SSD. After all, the surge in data generated means there will be a massive amount to store and process, suggesting an all-hands-on-deck scenario where multiple varieties of storage work in tandem. A rising tide lifts all boats, as they say.

Whether you’re buying or disposing of data storage capacity, learn more about how Horizon Technology leverages its deep industry expertise to support your enterprise hard drive needs.